The import file process allows for a CSV file to be uploaded and automatically match payment details with existing Payment Transactions generated by the Payment Schedule processor (invoices), or payments submitted from the Checkout online with the BPAY payment option selected.

The matching process:

- The processor searches for Payment Txns that match the Customer Reference Number (CRN) AND:

Status is "Awaiting Payment" OR "Confirmation" AND

Payment Source is "BPAY" OR Transaction Source is "Import File" OR Transaction Source is "Payment Schedule" AND

Payment Form on Payment Txn matches Payment Form on Import File header. - Use the list above, the processor will look for any transactions that have an exact match on the Amount.

- If there are no Payment Txns with the same Amount for that Customer Reference Number (CRN) , then the matching process will loop through the Payment Txns selected in item (1) :

- Will look for other transactions and will start applying the amount from the oldest to the newest based on Transaction Date.

- If there funds left over, then it will apply the remainder to the oldest Payment Txn. Note, this creates a second related "Import File Line Item Payment Txn" entry.

- If there are a short fall of funds AND the Payment Form - field: Payment Type is NOT "Donation" or "BPAY", then a new Payment Txn will be created for the shortfall and will have a status of “Awaiting Payment.”. In this scenario, the customer/donor still has more to pay.

- If there are a short fall of funds AND the Payment Form - field: Payment Type is IS "Donation" or "BPAY", then the last processed Payment Txn is updated to reflect the amount received. In this scenario, the customer/donor does NOT have anything more to pay.

- If there are no Payment Txns on file, then a new Payment Txn will be generated using the contact details that have the Customer Reference Number (CRN) allocated.

- If there are no contacts with the Customer Reference No. on file, then the payment will be uploaded with as much details as possible from the imported file. This will need to be manually edited before it can be processed.

When the process allocates amounts to Payment Txns, it will:

- Update the Payment Txn has its status updated to "Payment Complete"

- Create a related "Import File Line Item Payment Txn" record with the Amount allocated

Worked Examples of Allocation

If current Payment Txns with Status of “Awating Payment” were:

| Payment Txn | Transation Date | Amount |

| PAY-001 | 1 Jan 2025 | $30 |

| PAY-002 | 12 Jan 2025 | $80 |

| PAY-003 | 20 Jan 2025 | $5 |

If amount received was $80 (Exact amount) then:

- An exact match is found with PAY-002 and this is marked as fully paid

If amount received was $100 (under payment) then:

- Allocation starts from the oldest transaction

- PAY-001 has $30 allocated

- PAY-002 has $70 allocated and the amount is adjusted to $70.

- As there is a shortfall, with PAY-002, this is cloned and amount set to $10 (The shortfall of $80 - allocated $70). The status is left at “Awaiting Payment”

If the amount recieved was $140 (over payment) then:

- Allocation starts from the oldest transaction

- PAY-001 has $30 allocated

- PAY-002 has $80 allocated

- PAY-003 has $5 allocated

- The is still a over payment of $15 ($140 - $30 - $80 - $5), so PAY-001 is updated have a second related "Import File Line Item Payment Txn" created and the amount on the Payment Txn is updated to $45 ($30 + $15)

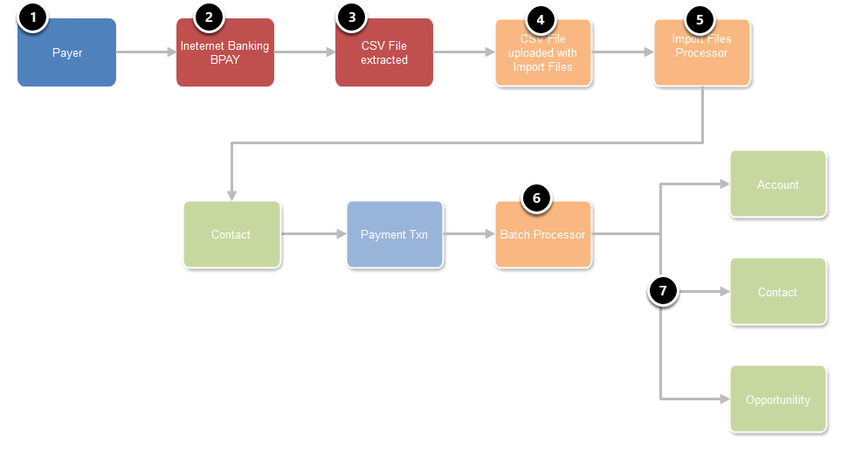

1. BPAY reconciliation using Import Files overview

- A Payer/Donor receives a bill to pay or decides to make an online donation

- They pay using their internet banking and select BPAY option

- A BPAY CSV file is extracted

- The CSV file is uploaded using the Payments2Us Import File process

- After checking the import details, the Salesforce user presses the "Process" button to process the import files.

The Import Files Processor checks to see if there any Payment Txns with the Customer Reference Number matching the Import line CRN and with a status of Awaiting Payment.

If no Payment Txns can be identified, then the processor looks for Contacts with a matching CRN. If there is one, a Payment Txn is created for the BPAY amount. - The normal batch processor runs and creates/updates related objects including (7) Accounts, Contacts and optionally Opportunities.

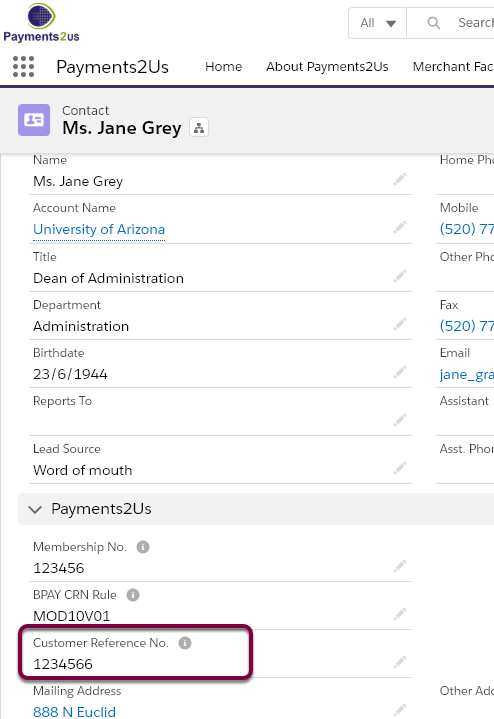

2. Set up Customer Reference Number (CRN)

The import file process matches the imported Customer Reference Number (CRN) with the Customer Reference Number (CRN) on a Payment Txn with "Awaiting Payment" Status, or links the transactions to a Contact with a matching Customer Reference Number (CRN)

Before running this procedure, see How to Setup BPAY Customer Reference Numbers.

2.1. Importing and Processing BPAY Transactions

To process BPAY transactions, follow the steps in How to import CSV files

NOTE, the Import File selected Merchant Facility and Payment Form will need to match the Payment Txn's Merchant Facility and Payment Form in order to be linked.

In addition Payer Name or Last Name will need to be included with the import IF there are no existing Contacts with a matching CRN.